Yesterday, we got the PMI survey data for U.S. manufacturing in the month of May and the overall index was slightly above 50, which indicates expansion. So, of course, the headline readers were re-assured that the U.S. is not in recession. Right? Nope.

First, here’s the data:

PMI Manufacturing Index Flash

Released On 5/23/2016 9:45:00 AM For May, 2016:

Consensus: 50.8

Consensus Range: 50.5 to 51.5

Actual: 50.5

And here is the chart for the Index showing that it is just above contraction:

The PMI Index includes all sorts of data about future expectations and other kinds of hopium, rhymes with opium.

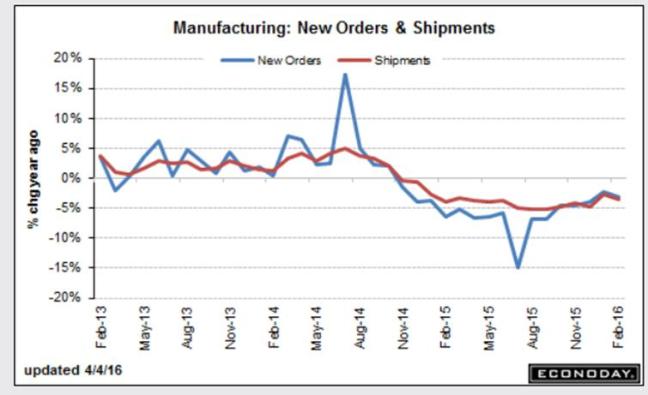

Now for a very important fact: in May actual manufacturing production declined for the first time since September, 2009. This news about output was not in the headline stories you read. The chart below looks less positive, doesn’t it?

You probably also didn’t see the comments from Markit’s Chief Economist Chris Williamson:

- “The weak manufacturing PMI data cast doubt on the ability of the US economy to rebound from its disappointing start to the year in the second quarter. The survey is signalling that manufacturing will act as a drag on economic growth in the second quarter, leaving the economy once again dependent on the service sector, and consumers in particular, to sustain growth.”

- “Output is falling for the first time since the height of the global financial crisis, with factories hit by slowing growth of order books and falling exports. Backlogs of work are also dropping at the fastest rate since the recession, meaning firms will be poised to cut capacity unless inflows of new work start to pick up again.”

- “The survey’s employment gauge is in fact already running at a level consistent with a further reduction in the official measure of factory payroll numbers.”

If you are going to read one of these reports, you need to read the whole thing.